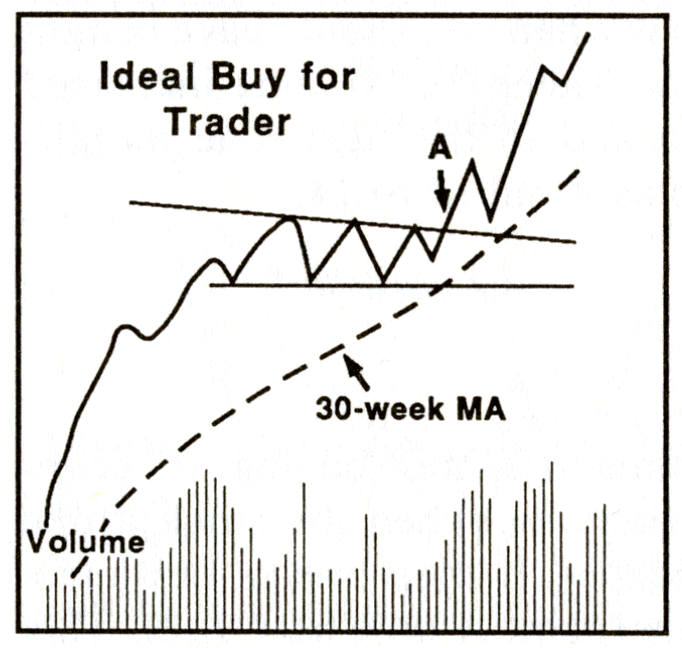

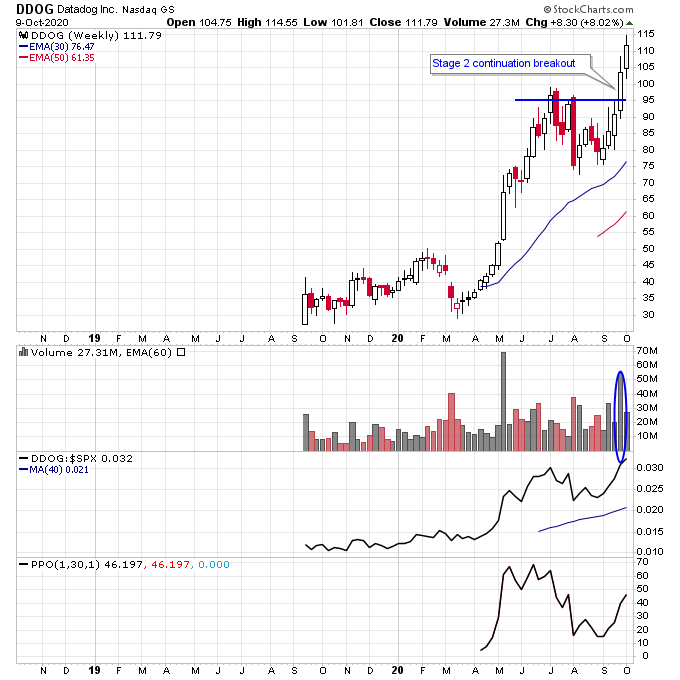

Profitable trading is not just about buying the right stocks. It’s about buying the right stocks, at the right time. The time to buy stocks using the Stage Analysis system is when a stock completes a Stage 2 breakout or a Stage 2 continuation breakout.

This is the point at which odds are higher that the stock will now be in an uptrend instead of being in a previous sideways trend. And by buying the breakout early it gives you two very important things:

- A better risk/reward setup because you’re buying close to the breakout with a stop around the breakout area

- The potential to profit from a new uptrend that is in its early stages

On the flip side if you miss a stock and buy later in the uptrend you could be at worst setting yourself up for a losing trade if you’re buying too late. Or you could be at best getting in a stock that is about to start consolidating and going nowhere which ties up your trading capital.

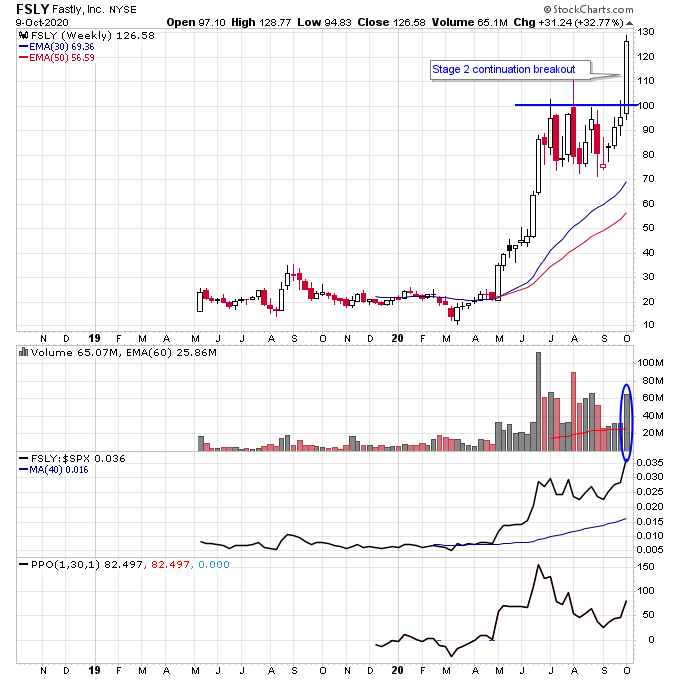

When trading Stage 2 continuation breakouts I like to establish a position during the breakout week and then buy on any weakness over the next 1-2 weeks. This gives me the ability to use volatility to my advantage and get a better cost basis. And by scaling in I can use a wider initial stop until I have a full position, which helps with initial volatility in the stock.

Three recent Stage 2 continuation breakouts I’ve entered since the recent pullback are FSLY, DDOG, and BE. These stocks are all meeting the criteria of high quality Stage 2 breakouts including high volume on the breakout, no resistance, strong sectors, relative strength against the S&P 500 and they are liquid stocks with institutional participation.

Disclosure: I am long FSLY, DDOG, BE.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.