2021 I would characterize as having 2 distinct parts:

- A speculative period from Jan-Feb 2021 where many stocks went straight up into blow off moves. This was the culmination of the 2020 bull market.

- A sideways bear market period from Feb 2021 until now which I discussed in my recent article here.

During the speculative period many stocks went up multiple hundreds of percent in a short period of time.

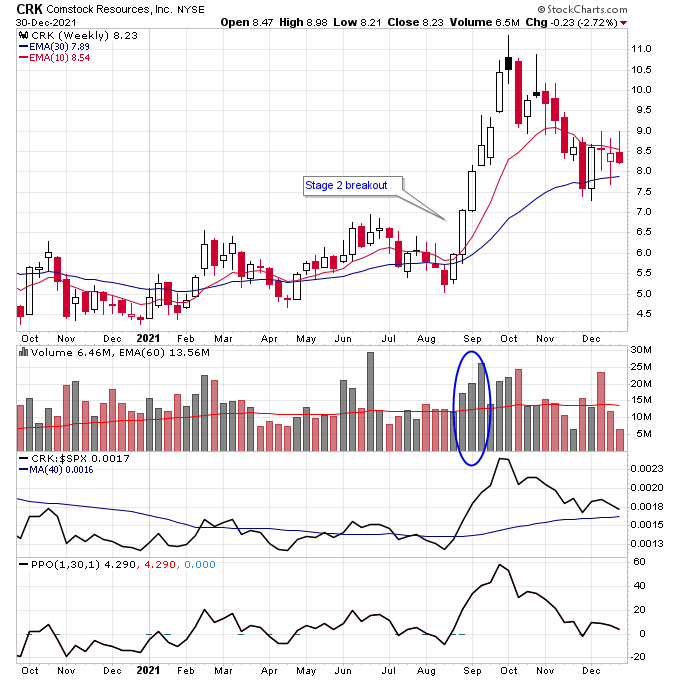

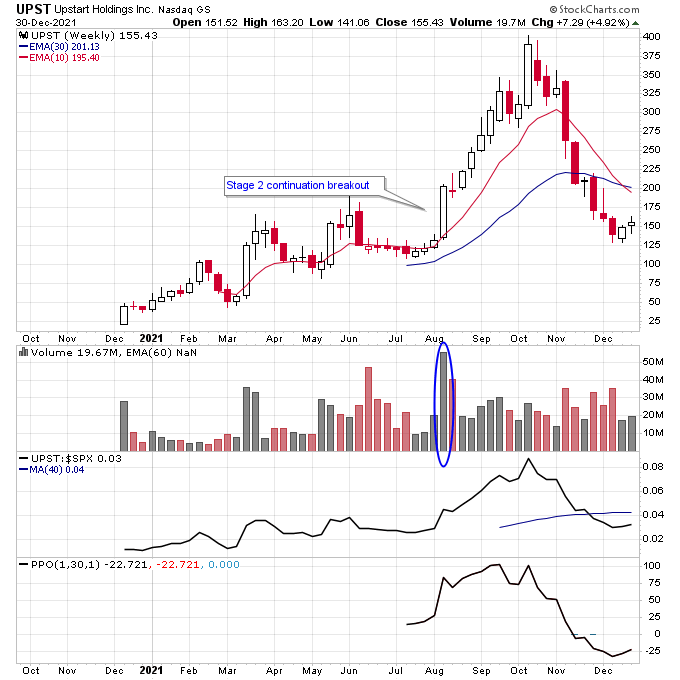

And during the sideways period after February 2021 it was much harder to find stocks that ran for more than 1-3 weeks. In fact many stocks broke out and made strong initial moves only to fall back down and erase the move. This happened multiple times with stocks like UPST and CRK which eventually made bigger moves after a few false breakouts.

So in general traders that were fast to take profits did much better than traders looking to play a longer term move as overall market conditions simply didn’t allow most stocks to run for more than a few weeks. During the end of 2021 this was even more pronounced because stocks like RBLX broke out on huge volume while other stocks like PTON were in Stage 4 death spirals. This dichotomy tilted towards the bears and another stock market correction slammed into the market in December and wiped out the moves in many stocks that started breaking out in November and December 2021.

So to boil it down very easy market conditions to start the year until February, followed by much tougher conditions for the rest of the year.

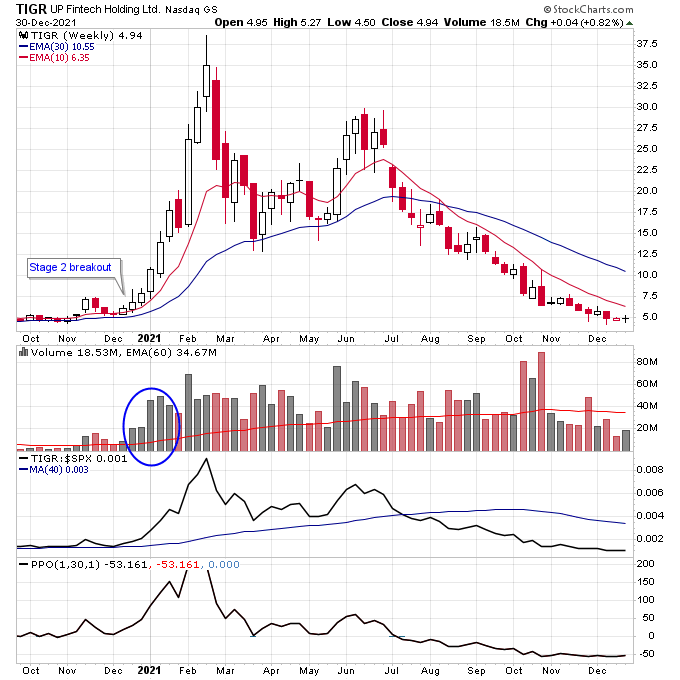

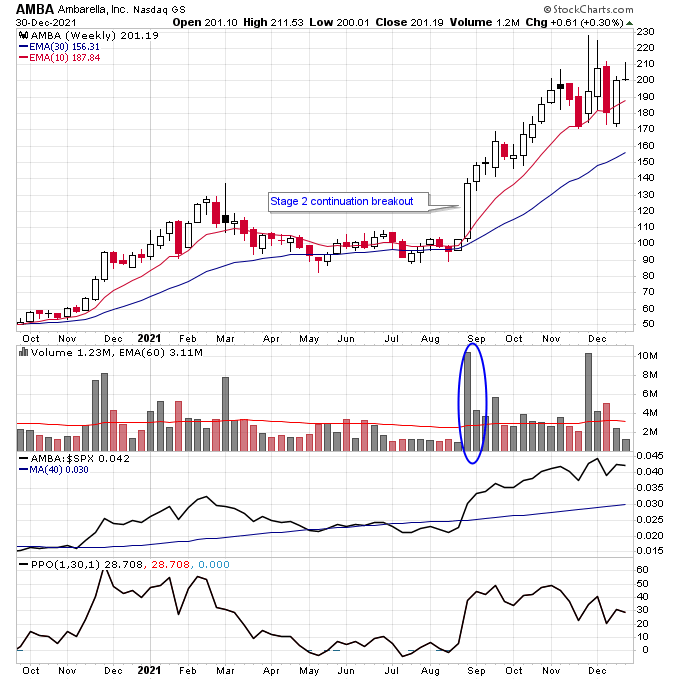

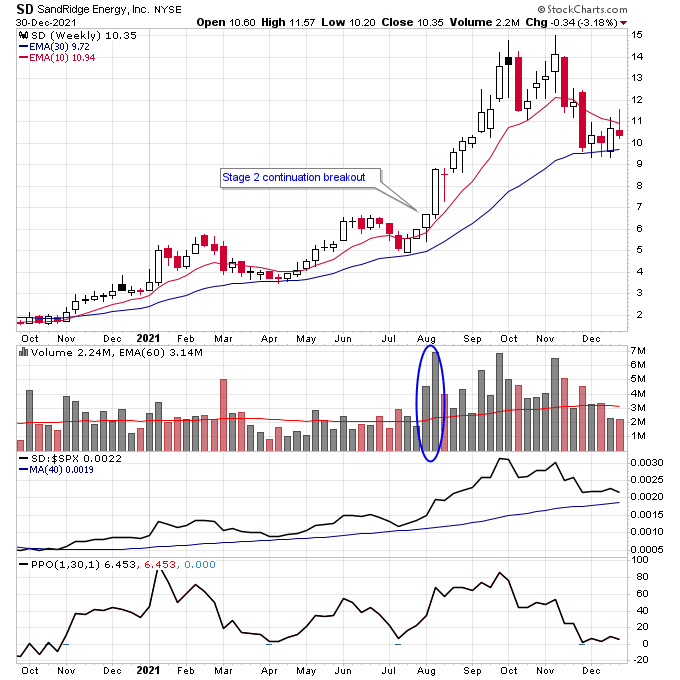

The following are some of the Stage 2 breakouts that ran for more than 3 weeks that I traded this year. If you notice on every single one of these breakouts the following conditions were present:

- The stock broke out on a big increase in volume indicating a big shift in demand vs. supply

- The stock had no resistance after the breakout

- The stock was in a strong sector or had sister stocks that were also in Stage 2 or had recently broken out

- The stock was outperforming the S&P 500

- The stock broke out of a large basing pattern

These criteria above are the attributes of a high quality Stage 2 breakout as described by Stan Weinstein in Secrets For Profiting In Bull And Bear Markets.

TIGR broke out right at the end of 2020 and sister stock FUTU was also breaking out on big volume so this was a good sign for both of these stocks. TIGR actually had multiple false breakouts in 2020 but this final breakout occurred on consecutive weeks of huge volume which tends to happen in the best breakouts.

TLRY had group strength from multiple cannabis related stocks during its move which was faster and furious. The incredible blow off move and crash down happened very quickly.

AMBA completed a Stage 2 continuation breakout after earnings on strong volume in August. This stock was also in a strong group with other semiconductor names like NVDA and AMD doing well in 2021.

SD is a natural gas producer and of the top 40 performing stocks with market caps over $2 billion this year 12 of them or 30% were oil and gas stocks. So this sector produced a lot of big winning stocks in 2021. What I liked about this chart was the fact it had no resistance on the breakout which was still rare for most oil and gas stocks which had some resistance.

CRK was a stock that had multiple failed breakouts before this final breakout caught some traction in August. This is a good lesson that if a stock fails its breakout but remains in a base it can simply setup again and breakout later, especially if it is in a strong group. Sometimes stocks need to have a few false breakouts to shakeout the weak hands in Stage 1, which is why bases can go on for a long period of time before the real breakout.

UPST was a stock that showed a ton of relative strength early in the year trying to breakout while the market was not doing much in March and May 2021. But these breakouts didn’t do much largely likely do to a weak market. The breakout in August though occurred on monster volume and created a multi-week trending move and one of the biggest moves in any stock after February 2021.

Check out my Stage Analysis Screening Tool at: https://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.