If gold entering a powerful Stage 2 uptrend is the surprise of 2019 then the only thing that could top that is a big move higher in oil and gas stocks. Once a loved sector in the first decade of the 2000s, oil and gas stocks are now universally loathed and with good reason. Most of them are Stage 4 disasters and have terrible looking charts.

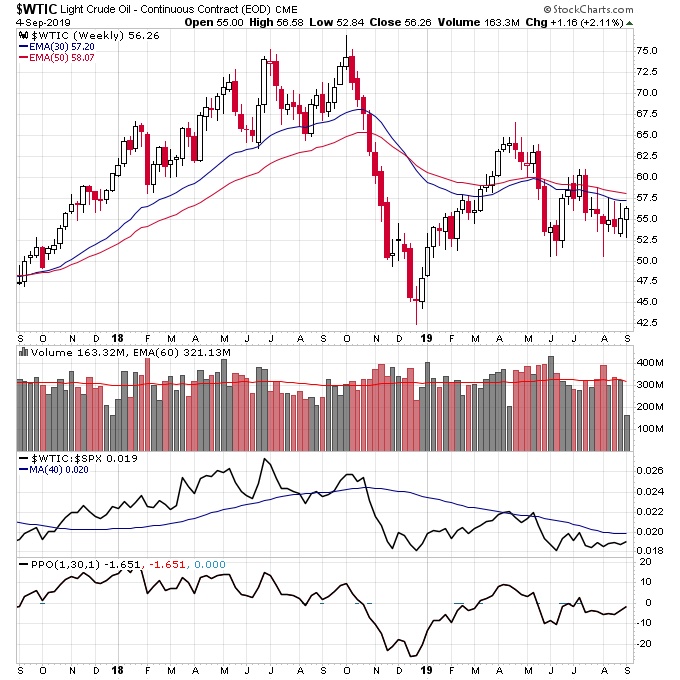

However what is interesting about oil is it’s been tightening in a narrower range right under the 30-week moving average for over a month in perhaps the tightest trading range in a few years. The chart looks to me like it could be setting up a surprise move higher and which would go along with the recent strength in gold.

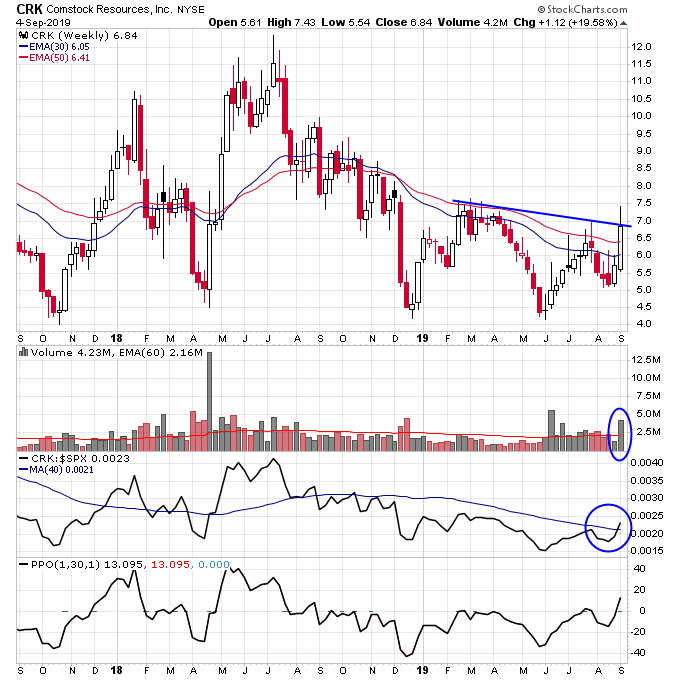

CRK is a natural gas play that is attempting a Stage 2 breakout this week on what should be its biggest up volume week of the year. If we get a move higher in oil I’d expect more oil and gas stocks to start breaking out as well, although there are quite a few oil and gas stocks that are still in Stage 4 with a large amount of overhead resistance. The key will be finding the stocks with the least amount of overhead resistance possible to uncover stocks with the best potential.

Disclosure: I am long CRK.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.